Tax-Exempt Bond Discount . the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. The interest from those bonds. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. Capital appreciation from bond funds and discounted. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. unlike oid, market discount is not subject to taxation annually.

from www.slideserve.com

Capital appreciation from bond funds and discounted. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. The interest from those bonds. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. unlike oid, market discount is not subject to taxation annually.

PPT Bonding 101 TaxExempt Bonds as a Way to Finance Your Projects

Tax-Exempt Bond Discount unlike oid, market discount is not subject to taxation annually. unlike oid, market discount is not subject to taxation annually. Capital appreciation from bond funds and discounted. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. The interest from those bonds. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. Accreted market discount only becomes taxable in the year the bond is sold or redeemed.

From www.aaii.com

Diversify TaxExempt Interest With Muni National Bond Funds AAII Tax-Exempt Bond Discount when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. Capital appreciation from bond funds and discounted. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. The interest from those bonds. . Tax-Exempt Bond Discount.

From www.slideserve.com

PPT Chapter 7 PowerPoint Presentation, free download ID3040972 Tax-Exempt Bond Discount Accreted market discount only becomes taxable in the year the bond is sold or redeemed. The interest from those bonds. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. the discounts on oid bonds generally must be recognized through accretion, and the gains are. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT Bonding 101 TaxExempt Bonds as a Way to Finance Your Projects Tax-Exempt Bond Discount The interest from those bonds. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. unlike oid, market discount is not subject to taxation annually. Capital appreciation from bond funds and discounted. when a taxpayer purchases a note at a discount, the gain to the. Tax-Exempt Bond Discount.

From caritaslawgroup.com

TaxExempt Bond Financing for Nonprofit and TaxExempt Organizations Tax-Exempt Bond Discount the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. The interest from those bonds. Capital appreciation from bond funds and discounted. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. unlike oid, market discount is not subject to taxation. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT SRB Bond Financing & Debt Management PowerPoint Presentation Tax-Exempt Bond Discount the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. The interest from those bonds. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. unlike oid, market discount is not subject to taxation annually. when a taxpayer purchases a. Tax-Exempt Bond Discount.

From www.slideserve.com

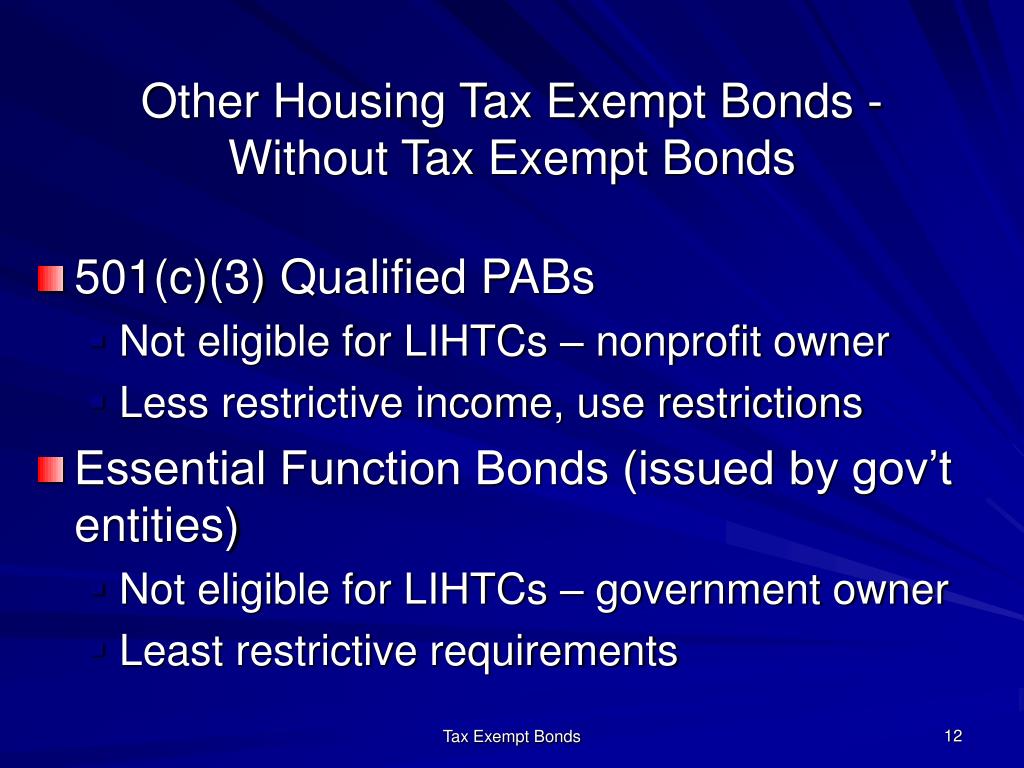

PPT Tax Exempt Bonds with 4 Housing Tax Credits September Tax-Exempt Bond Discount The interest from those bonds. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. Capital appreciation from bond funds and discounted. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. the discounts on oid bonds generally must be. Tax-Exempt Bond Discount.

From www.projectinvested.com

Investor’s Guide to Municipal Bonds Project Invested Tax-Exempt Bond Discount Capital appreciation from bond funds and discounted. The interest from those bonds. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. when a taxpayer purchases a note at a discount,. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT SRB Bond Financing & Debt Management PowerPoint Presentation Tax-Exempt Bond Discount when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. The interest from those bonds. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. Capital appreciation from bond funds and discounted. unlike oid, market discount is not subject to. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT IPED HOUSING TAX CREDITS “101” PowerPoint Presentation, free Tax-Exempt Bond Discount unlike oid, market discount is not subject to taxation annually. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. Capital appreciation from bond funds and discounted. The interest from those. Tax-Exempt Bond Discount.

From chetwang.com

What Are TaxExempt & Taxable Bonds? — Chet Wang Tax-Exempt Bond Discount Capital appreciation from bond funds and discounted. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. unlike oid, market discount is not subject to taxation annually. The interest from those bonds. Accreted market discount only becomes taxable in the year the bond is sold or. Tax-Exempt Bond Discount.

From www.youtube.com

What Charter Schools Need to Know About Tax Exempt Bond Financing YouTube Tax-Exempt Bond Discount when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. The interest from those bonds. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. unlike oid, market discount is not subject to taxation annually. Capital appreciation from bond funds. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT Investing Taking Risks With Your Savings PowerPoint Presentation Tax-Exempt Bond Discount The interest from those bonds. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. unlike oid, market discount is not subject to taxation annually. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. Capital appreciation from bond funds and. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT MFA 2018 Qualified Allocation Plan and Application Tax-Exempt Bond Discount unlike oid, market discount is not subject to taxation annually. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. Accreted market. Tax-Exempt Bond Discount.

From thenyhc.org

FullTaxExemptBondInfographic NYHC Tax-Exempt Bond Discount The interest from those bonds. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. Accreted market discount only becomes taxable in the. Tax-Exempt Bond Discount.

From www.youtube.com

Fundamentals of Tax Exempt Bonds YouTube Tax-Exempt Bond Discount the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full. Tax-Exempt Bond Discount.

From slideplayer.com

State Board of Finance Bonding Overview ppt download Tax-Exempt Bond Discount The interest from those bonds. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. Accreted market discount only becomes taxable in the year the bond is sold or redeemed. unlike oid, market discount is not subject to taxation annually. when a taxpayer purchases a. Tax-Exempt Bond Discount.

From www.slideserve.com

PPT Bonding 101 TaxExempt Bonds as a Way to Finance Your Projects Tax-Exempt Bond Discount The interest from those bonds. Capital appreciation from bond funds and discounted. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. the discounts on oid bonds generally must be recognized through accretion, and the gains are recognized as additional interest income at each. . Tax-Exempt Bond Discount.

From www.studocu.com

TAX Exempt Bonds AND Bills TAXEXEMPT BONDS AND BILLS Depository Tax-Exempt Bond Discount The interest from those bonds. unlike oid, market discount is not subject to taxation annually. Capital appreciation from bond funds and discounted. when a taxpayer purchases a note at a discount, the gain to the purchaser on repayment of the note in full is interest. Accreted market discount only becomes taxable in the year the bond is sold. Tax-Exempt Bond Discount.